By Trévon Austin in the USA:

Richest 400 Americans paid lower taxes than everyone else in 2018

10 October 2019

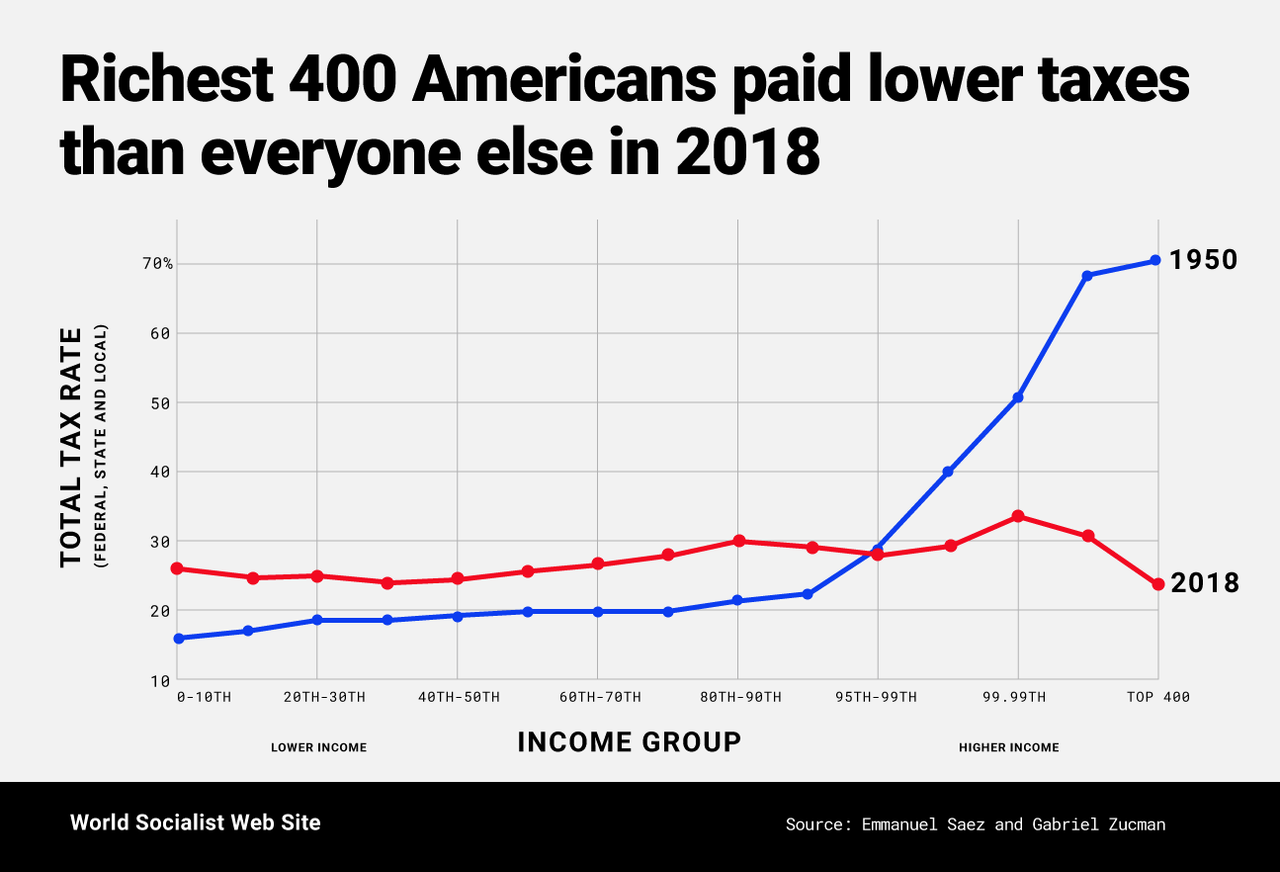

According to an analysis by noted economists Emmanuel Saez and Gabriel Zucman, previewed this week by New York Times columnist David Leonhardt, the wealthiest American households paid a lower tax rate last year than every other income group for the first time in the country’s history.

Saez and Zucman, both professors at the University of California Berkeley, detail the phenomenon of declining taxes for the richest Americans in their soon-to-be released book, The Triumph of Injustice.

The pair compiled a historical database composed of the tax payments of households in various income percentiles spanning all the way back to 1913, when the federal income tax was first implemented. Their research uncovered that in the 2018 fiscal year the wealthiest 400 Americans paid a lower tax rate—accounting for federal, state, and local taxes—than anyone else.

The overall tax rate paid by the richest .01 percent was only 23 percent last year, while the bottom half of the population paid 24.2 percent. This contrasts starkly with the overall tax rates on the wealthy of 70 percent in 1950 and 47 percent in 1980.

The taxes on the wealthy have been in precipitous decline since the latter half of the 20th century as successive presidential administrations enacted tax cuts for the rich, suggesting that they would result in economic prosperity for all. Taxes that mostly affect the wealthy, such as the estate tax and corporate tax, have been drastically cut and lawyers have been hard at work on the beliefs of their wealthy patrons planning out the best schemes for tax avoidance, seeking to drive tax rates as close to zero as possible. The impetus for the historical tipping point was the Trump Administration’s 2017 tax reform, which was a windfall for the super-rich.

Supported by both the Republican and Democratic Parties, the two parties of Wall Street, Trump’s tax cuts were specifically designed to transfer massive amounts of wealth from the working class to the ruling elite.

The corporate tax rate was permanently slashed from 35 percent to 21 percent, potentially increasing corporate revenues by more than $6 trillion in the next decade. The bill also reduced the individual federal income tax rate for the wealthy and included a number of other provisions to further ease their tax burden.

The story is different for many middle- and working-class Americans. According to multiple analyses of the 2017 tax reform, 83 percent of the tax benefits will go to the top 1 percent by 2027, while 53 percent of the population, or those making less than $75,000 annually, will pay higher taxes. At the same time, the reform will sharply increase budget deficits and the national debt, granting the pretense for the further destruction of domestic social programs.

Furthermore, a majority of Americans are paying higher payroll taxes, which cover Medicare and Social Security. The tax increased from 2 percent just after World War II, to 6 percent in 1960, to 15.3 percent in 1990, where it stands today. It has risen to become the largest tax that 62 percent of American households pay.

The result of the multitude of changes to the US tax system over the last three-quarters of a century is one that has become less progressive over time. The 2017 tax reform effectively set up the foundation for a regressive tax policy where the wealthy pay lower tax rates than the poor.

The implementation of a regressive tax structure has played a major role in engineering the redistribution of wealth from the bottom to the top that has brought social inequality in America to its highest level since the 1920s.

According to Leonhardt’s preliminary Times review of The Triumph of Injustice, Saez and Zucman offer a solution to the current unjust tax system in which the overall tax rate on the top 1 percent of income earners would rise to 60 percent. The pair claim that the tax increase would bring in approximately $750 billion in taxes. Their tax code also includes a wealth tax and a minimum global corporate tax of 25 percent, requiring corporations to pay taxes on profits made in the United States, even if their headquarters are overseas.

In an interview with Leonhardt, Zucman states that history shows that the US has raised tax rates on the wealthy before so therefore it should be possible to do so now.

However, the last half century of counterrevolution waged against the working class makes the parasitic nature of the ruling elite absolutely clear, and underscores the well-known fact that the US is ruled by an oligarchy that controls the political system. Neither the Democrats nor the Republicans, who both represent this oligarchy and bear responsibility for the tax system, will make any effort to implement Saez and Zucman’s modest proposal.

The Triumph of Injustice, by economists Emmanuel Saez and Gabriel Zucman (2019, W. W. Norton), documents how governments have systematically allowed the wealthy to dodge taxes, and then cut corporate tax rates in the name of “closing tax loopholes,” helping to fuel runaway inequality: here.

LikeLike

LikeLike

LikeLike

Pingback: Dutch billionaires even richer | Dear Kitty. Some blog

You mean, financing far-right politicians, leading to plutocracy?

LikeLike

As the article says, the richest people pay LESS taxes than others.

And how do billionaires become billionaires? Eg, Jeff Bezos, the richest man in the world:

LikeLike

And how did Donald Trump become a billionaire?

LikeLike

Pingback: Billionaire politician wants more taxes for poor people | Dear Kitty. Some blog

Pingback: Homeless Christmas in Donald Trump’s USA | Dear Kitty. Some blog

LikeLike

Petrel41, what are your thoughts on the estate tax?

LikeLike

Typical Donald Trump policy, taking money from poor people to benefit himself and fellow billionaires:

https://www.bloomberg.com/news/features/2018-05-15/trump-tax-overhaul-doubles-estate-tax-exemption-for-super-rich

LikeLike

Because imequalty and privileges are wrong. And the Trump presidency shows how wrong.

LikeLike

Why do you your dog whistle MAGA white nationalism about ‘free stuff’ here, not on white nationalist sites?

LikeLike

If you inherit a billion dollars then you have not worked foer it.

LikeLike

No more trolling here for you insulting people you know nothing about and praising the Donald Trump class. This is my blog, not yours.

LikeLike

On March 14, 1995, the House Means and Ways Committee voted to approve a Republican plan to cut federal taxes by $189 billion over the following five years, and nearly $700 billion over the following 10 years, with the majority of the cut benefiting the wealthiest individuals and families.

https://www.wsws.org/en/articles/2020/03/09/twih-m09.html#top

LikeLike

Pingback: Bernie Sanders keeps fighting | Dear Kitty. Some blog

Pingback: Coronavirus update from the USA | Dear Kitty. Some blog

Pingback: Donald Trump, the Rasputin of the USA? | Dear Kitty. Some blog